What Does Extended Stamp Duty Mean For Paperwork?

Published:

Everything you need to know about the extended stamp duty (SDLT) holiday

What the extension means

The Stamp Duty holiday was announced on the 8th June 2020 by Rishi Sumak, and following the 2021 budget announcement, has now been extended until June 2021.

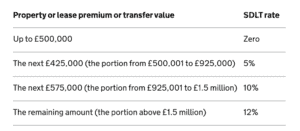

It means only properties sold for over £500,000 will have to pay Stamp Duty. Any properties sold below that will not be charged.

To work out the stamp duty rates see the table below from HMRC:

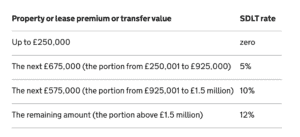

Post-June 2021

If Stamp Duty is reinstated in June 2021, home buyers purchasing properties above the £250,000 threshold will have to pay Stamp duty. The below table from HMRC shows the rates buyers will have to pay.

First Time Buyers

As set out by HMRC, first-time buyer special rates will be replaced by the stamp duty holiday rates as above until June 2021.

Industry Reaction to Stamp Duty Holiday

Many agents have welcomed the holiday as it has meant the collapsing housing market has been given that much-needed kick-start after numerous National Lockdowns. The market was virtually halted as the UK went into lockdown, and many agents struggled to make ends meet.

The holiday has increased sales tenfold and meant many who wouldn’t have sold/bought have done. A whole 37% of people said they wouldn’t have bought a house if the threshold was at the usual £250,000, according to Cornerstone Tax..

However, many agents have voiced that when the threshold lowers back to half of what it currently is, many buyers caught in the change-over date will face a ‘cliff edge’ or rates to pay. This is likely to cause many failed transactions, causing fees to be lost and unnecessary stress for everyone involved.

This is coupled with the fact that property transactions are taking longer due to the current pandemic restrictions.

Therefore, the property industry is calling for a gradual ease back to the usual threshold, or perhaps even a rise in the property threshold permanently to the first-time buyer threshold of £300,000.

Foreign buyers

A few industry examiners have pointed out that the Stamp Duty Holiday doesn’t support all home buyers. Specifically, those moving from overseas to the UK. With a new PCL (prime central London properties) charge commencing from the 1st of April, overseas buyers will have to pay Stamp Duty, even if they’re first-time buyers.

“A better approach would have been to make the SDLT holiday only available to first-time buyers rather than all buyers. The Chancellor seems to be giving with one hand and taking with the other when it comes to overseas buyers, allowing them to have the benefit of the SDLT holiday, but then introducing a surcharge from 1st April.”

The Future of Property Transactions

How Can Electronic Transactions Help?

Almost all agents will have experienced a log-jam of property transactions during the pandemic, with processes naturally taking longer to complete. This obviously has been a considerable factor in the extension of the holiday, and if it is to end in June, buyers and agents will again face the same issues. Many buyers risk being caught in the middle of their transactions when Stamp Duty Tax is lowered to £250,000.

But, there’s ways many firms have been speeding up transaction time using electronic contracts and eSignatures.

It’ll come as no surprise that electronic deals are faster on all accounts, meaning the parties can sign from their own homes and there’s no wait times for postage. Implementing a fully digital process for buyers and sellers means less stress, safety for everyone (taking Covid-19 into account) and reduced filing and paperwork costs.

If you’re already using a CRM or online portal to help with digital transactions, you can easily integrate Signable’s eSigning system with our API or Widget features. You’ll keep the professionalism and clarity, but with the benefit of speed and security.

HMRC’s Digital Processes

With over 99% of the HMRC forms and contracts being requested electronically, this is likely the forward motion the industry will see completed in the next couple of years.

“37% of all people to buy a property in the UK since 2007 – equating to 6.46 million – have experienced a deal fall through as a result of long delays and chain complications”

Hopefully, the Extended Stamp Duty Holiday marks a change in the way the government reacts to the property market and what we need most. Mortgages are now fully paperless and are now a well-oiled machine, so if we can see the end-to-end process going paperless, transaction delays will hopefully become a thing of the past or at least heavily reduce.