New Financial Year 2021 Changes & Top Tax Software

Published:

When Is The New Financial Year 2021?

The UK 2021 Financial year begins on 6th April 2021. This means you’re probably planning your 2021 budget now. We’ve rounded up some of the key pieces of software becoming invaluable to 2021 businesses, so you know what’s worth investing in and what’s a passing trend.

The State of IT 2021 report showed that Covid has indeed affected businesses for the long-term, with ‘76% of businesses plan on long-term IT changes.’ With this shift, we’re seeing more priority on the “essential” tech to help workers do their jobs more efficiently, over “nice to have” tech.

What’s changing from April 6th 2021? – The Headlines…

Personal Income Tax Brackets (UK)

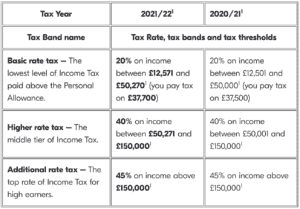

The low and middle tax rates have been dropped, meaning you’ll pay tax on a small percentage of your income. The below table from Crunch shows the updated rates for the UK.

Company Directory Tax Salary Changes

As a company director or shareholder, it’s advisable that your company should pay you a salary of £8,840 and dividends of up to £41,430. This means you’ll use the basic tax band rates at 20%.

If you take more income in dividends, the tax rate increases of 32.5%, as you’ll be in a higher band of tax.

The 2021/2022 Tax-Free Dividend Allowance will stay at £2,000.

National Minimum Wage Increases

The UK Minimum Wage amount per hour is increasing to £8.91/hr from 1st April and is now applicable to all workers above 23 years old.

Student Loans Repayment Plan Updates

Every year we see student loan thresholds increase, so it’s no surprise that the Department for Education has increased the earning thresholds to:

Plan 1 – From April 6th 2021: £19,895

Plan 2 – From April 6th 2021: £27,295

Scotland has introduced a Plan 4 for all those currently on Plan 1. You will be moved over from the 6th April 2021 and the threshold is set at £25,000.

Employee Pensions

There are no new changes this year to workplace pensions. The rate will remain at a minimum of 8% of the employee’s registered

Apprenticeships

In the UK, the apprentice scheme has been extended to Sept 2021, with payments increased to £3,000. Apprentices can now also make use of the new Flexible apprenticeship scheme, meaning that they’re able to work with a few employers at once.

Business Investment Tax Relief Changes

In order to help businesses reduce their tax bill by 130% of their investment spending, a new ‘super deduction’ scheme was announced.

See HMRC’s full breakdown for all New Financial year 2021 Updates.

To help you manage your finances and taxes in the new year, we’ve rounded up our Tax & Finance Software Top Picks:

Top tax software of 2021

TaxCalc

For 30 years TaxCalc has helped businesses of all sizes and shapes manage their accounts and tax with their easy to use software. Recently reviewed by TechRadar:

“TaxCalc is a solid choice for completing a UK-based tax return. We appreciate the streamlined interview process that focuses the questions on the relevant tax situation, and not peppering the user with endless inquiries into tax situations that do not apply to them.” – TechRadar

Simply TaxCalc does what it says on the tin and that’s what businesses are opting for in the new Tax year.

‘Plans to adopt emerging tech have dropped significantly in 2021, as IT buyers deprioritize cutting-edge features in favor of more pressing needs.’ – State of IT

See TaxCalc for more information.

Signable & TaxCalc

Through our integration partnership with TaxCalc, you’re able to sign off your tax returns and send everything electronically. When everything’s been completed, your documents are stored under SSL Encryption in the cloud.

‘Businesses expect to increase cloud and managed services spending in 2021, and Hardware spending in 2021 is expected to decline.’ – State of IT